Risk management is closely linked to legislation. By analysing the impact of new regulations on their activity and insurance policies, businesses can ensure that they are properly protected against risks. The introduction of Book 6 is an example of this

Book 6 entered into force on 1 January 2025 and applies to both new and current contracts. It is part of the reform of the Civil Code and concerns non-contractual liability. One important change is the extension of the liability of auxiliary parties such as subcontractors and employees, who are now more exposed to claims.

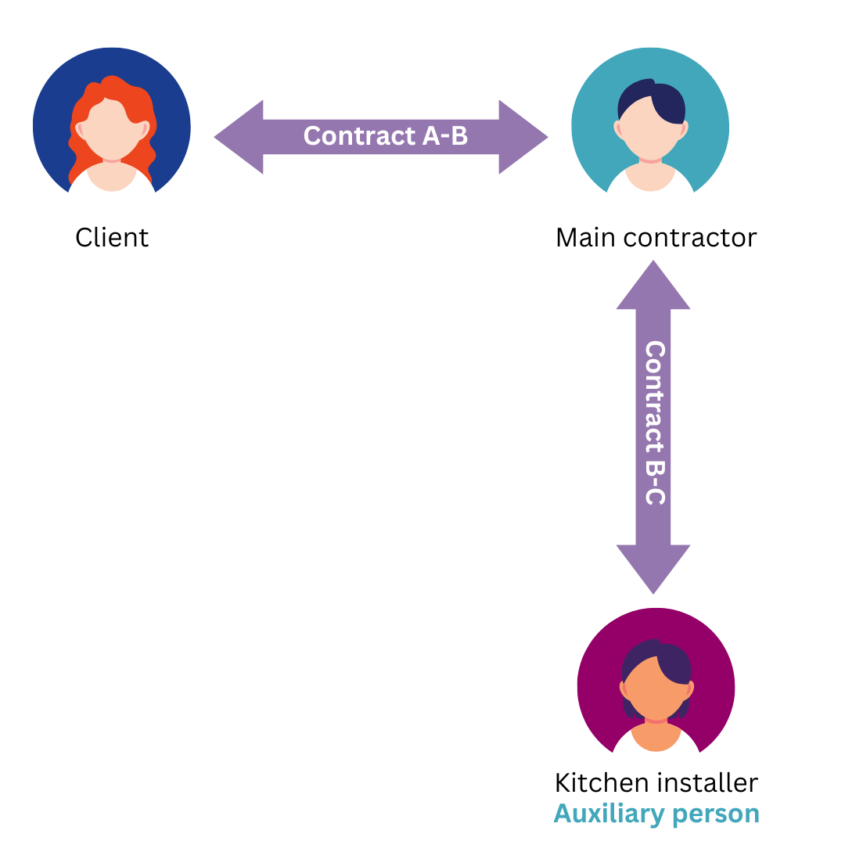

Auxiliary parties are found in all sectors. We can illustrate the concept with an example from the construction sector: a building owner (A) enters into a contract with a main contractor (B) for the construction of a house. The main contractor (B) brings in a self-employed subcontractor (C) for the construction of the kitchen. This makes the subcontractor (C) the auxiliary party of the main contractor (B).

Note too that all employees are their employer’s auxiliary parties. As a result, the scope of Book 6 extends well beyond any one sector.

Previously, auxiliary parties had quasi-immunity, which protected them against claims. Under Book 6, such protection no longer applies, and this has a serious impact on their position. The ban on concurrent claims has also been abolished, adding further to the increased exposure of auxiliary parties.

In practical terms, in our example from the construction sector the client (A) will now also be able to directly sue the subcontractor (C).

It is important to protect auxiliary parties properly, just like other parties, against potential claims for damages. We will explain two ways of doing this:

- Contracts: businesses can introduce contractual clauses to protect auxiliary parties.

- Insurance: liability and professional liability insurance may remedy this situation for auxiliary parties. For directors, directors’ liability insurance may be a useful approach.

We advise businesses to be alert to situations in which they work with auxiliary parties and to bear in mind that they may also be auxiliary parties themselves. As an insurance broker, we have extensive expertise in risk management and the insurance market and are well placed to give your business guidance in this area. Vanbreda supports clients by analysing vulnerabilities and advising on both contractual protection mechanisms and insurance solutions.