A supplementary pension plan is and remains a highly recommended personnel benefit when it comes to competitive salary packages. After all, using the same budget, you as an employer can offer higher net benefits to your employees compared to an increase in salary.

Even in times of low interest rates it remains difficult for an employee to close this gap with the returns of a private investment or an investment in, for example, property. Thanks to a group insurance, employees will still receive an attractive supplementary pension capital when they retire.

The Belgian statutory pension is not expected to rise significantly, which makes it particularly worthwhile as a caring employer to help your employees maintain a good standard of living after their retirement. So the more return, the better.

- Group insurance in Branch 21

For many years group insurances were mainly taken out in Branch 21. A Branch 21 group insurance offers employees a specific return, i.e. a contractually agreed interest rate that may be supplemented where applicable with a profit sharing, depending on the insurer’s results.

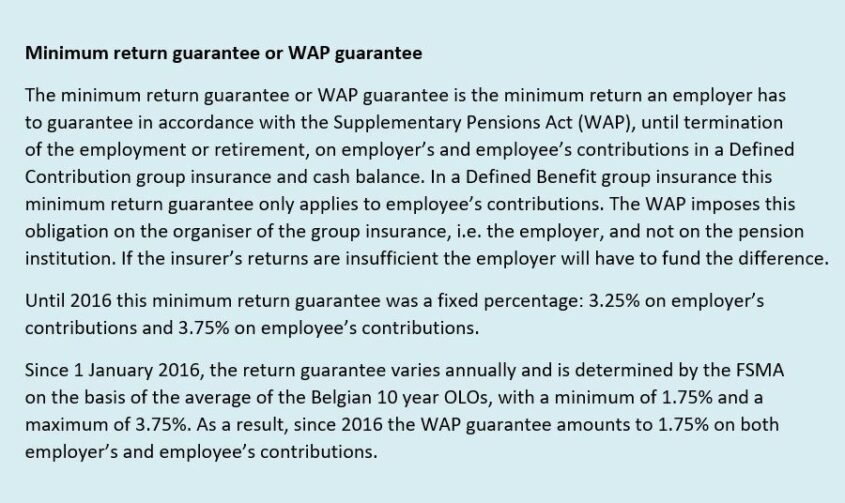

In times of low interest on Belgian OLOs, the interest rates guaranteed by insurers on a Branch 21 group insurance also decreased. Until 2013 the guaranteed interest rate was still 3.25%. Since then it has dropped well below 1%. Even (limited) profit sharing could often not fully close the gap with the WAP guarantee (see box for more information).

This created a conflict between what an employer is legally obliged to provide as a return and the returns they received from the insurers. This conflict is referred to as ‘underfinancing’ in technical jargon. It could potentially result in an employer being presented with an additional bill for the financing of their group insurance.

Important: most insurers recently increased their interest rates to 1.75% (see update for more details).

- Group insurance in Branch 23

Due to the continual low returns in Branch 21, we noticed a distinct change in the market in recent years leading to more and more employers investing in a Branch 23 formula with variable returns. Some switched to a pension fund.

By choosing pension products with variable returns employers are taking a chance in terms of higher returns and potentially smaller underfinancing risks. It is essential though to draw up the plans in such a way that the investment risks are adequately spread, as the economic situation has demonstrated that negative returns in Branch 23 are not entirely excluded. Historically, however, the returns on these types of insurance products were higher on average than the returns in Branch 21.

It is important to keep in mind that group insurance is a long term investment, until the retirement age of the insured person, and that stock market fluctuations are usually smoothed out given this long investment horizon.

Most insurers have recently announced a substantial increase in interest rates in Branch 21 group insurance policies. From 2024, most insurers in group insurance policies without a future guarantee will guarantee an interest rate of 1.75%. This is thus the same as the WAP guarantee, and it may also be supplemented by a profit share. Two insurers currently even offer higher interest rates of 1.80% and 2.00% respectively.

- This is for group insurance without a future guarantee, where the guaranteed interest rate at the start of the contract or scheme membership is only valid on the premiums that are paid as long as this interest rate is maintained. If the interest rate changes, the accrued reserves remain subject to the old interest rate until the planned end date of the contract. New premiums are invested at the new interest rate. Most existing group insurance policies are of this type.

- A smaller portion of existing group insurance policies are still of the type with a future guarantee, although it has not been possible to arrange new contracts of this type for some time. In group insurance with a future guarantee, the guaranteed interest rate at the start of the contract or scheme membership is valid on all premiums paid in the future. If the interest rate changes, the accrued reserves remain subject to the old interest rate until the planned end date of the contract. The element of the new premiums that does not exceed the original premium level is also invested at the old interest rate. Only premium increases (e.g. as a result of a pay increase) are invested at the new interest rate. In group insurance policies with a future guarantee, the guaranteed interest rates are considerably lower.

Given the potentially large differences between the interest rates of a group insurance policy with or without a future guarantee, depending on the seniority of the insured population it may be worthwhile for existing contracts with a future guarantee to be converted into contracts without a future guarantee.

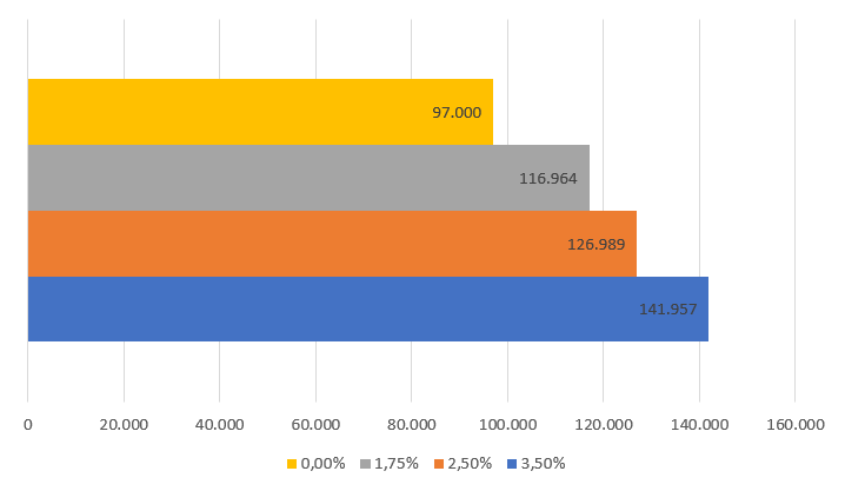

The annual return that a group insurance policy achieves through a guaranteed interest rate supplemented with possible profit sharing is an important consideration for the scheme members. A simple example illustrates the importance of returns in a group insurance policy, whether in Branch 21 or Branch 23. Assuming an annual premium of 5,000 euros and a term of 20 years (and allowing for a management fee of 3%), the following final capital amounts are achieved at an average return of 0%, 1.75%, 2.50% or 3.50% in a group insurance policy without future guarantee:

From 2025 onwards we also expect an increase in the legal guaranteed return (see box for more information). The interest rates on OLOs are once again on the up and the financial markets expect that these positive interest rates will be maintained for a longer period of time. Based on the current economic situation we estimate that the new WAP guarantee will be around 2.50%. It remains to be seen, however, whether the guaranteed interest rates in Branch 21 will rise to a comparable level.

It is definitely worthwhile, therefore, to take a closer look at the current returns on group insurance. We recommend investigating whether, on the one hand, the risk of underfinancing can be limited for the employer and, on the other hand, whether employees can obtain higher returns. In doing so, alternative pension accrual scenarios could be looked at for employees, e.g. a switch to a Branch 21 group insurance with higher guaranteed returns, a Branch 23 group insurance or a pension fund. With the right carefully considered approach, companies can give themselves and their employees a significant financial boost.

Would you like to investigate the potential positive impact of the current interest increases on you as an employer and on the supplementary pension accrual of your employees? If so, please contact your Account Manager Employee Benefits at Vanbreda Risk & Benefits.